Bitcoin’s transaction fees have fallen to just 0.96% of total block rewards so far in June — potentially marking a new low not seen since January 2022.

The decline underscores subdued on-chain activity, even as Bitcoin (BTC) trades near all-time highs. Luxor’s Hashrate Index shows that fees represented only 0.65% of block rewards over the last 24 hours. According to The Block’s data dashboard, Bitcoin’s seven-day average transaction count has dropped to its lowest point since October 2023.

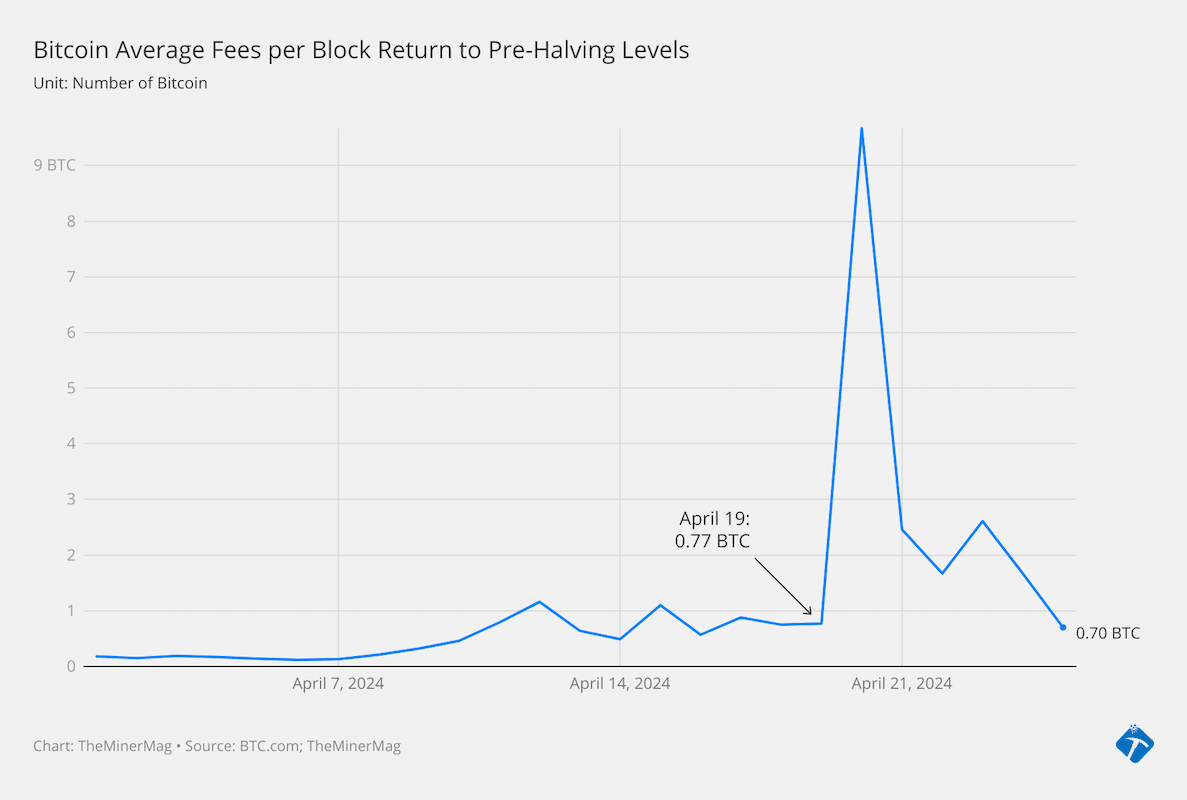

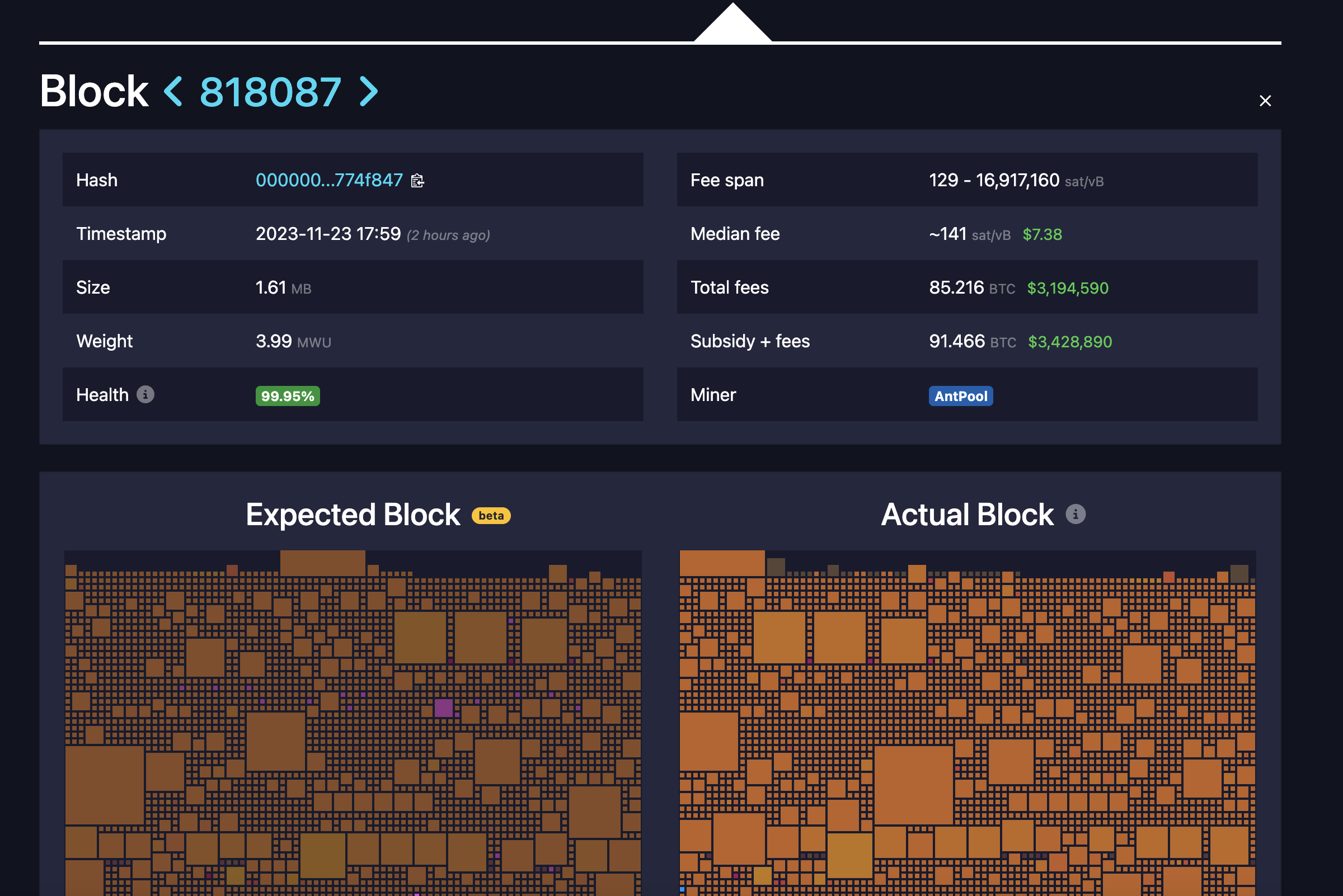

This continued slide in fee revenue follows the brief spike in April 2024, when the post-halving launch of Runes and memecoin mania temporarily congested the network. Since then, demand for blockspace has faded, dragging fees lower.

In May, fees made up just 1.3% of block rewards — already a historically low share — but June’s figures indicate a further decline. With current block rewards at 3.125 BTC, a sub-1% fee ratio means miners are earning less than 0.03 BTC per block from fees on average. This is a stark contrast to May 2024, the first full month after the halving, when fees still accounted for 6.7% of block rewards.

The drop in fee income compounds pressures on Bitcoin miners. Hashprice — a key metric for miner profitability — remains weak at $53 per petahash per second (PH/s), about 50% below pre-halving levels.

While the latest difficulty adjustment was flat, the decline in fees and an all-time high difficulty earlier this month continue to squeeze margins, despite BTC trading above $100,000.

Share This Post: