Enduring Wealth Capital Limited (EWCL), an entity closely linked to Bitmain, is increasing its investment in Cango as the U.S.-listed bitcoin miner continues to operate amid strained mining economics.

Cango said on Monday that EWCL agreed to subscribe to 7 million newly issued Class B ordinary shares for $10.5 million in cash, implying a per-share price of $1.50. The investment is governed by an agreement dated Dec. 29 and is expected to close in January, subject to customary conditions including approval from the New York Stock Exchange.

The transaction would lift EWCL’s ownership of Cango’s outstanding shares from about 2.81% to 4.69%. But because Class B shares carry 20 votes each, EWCL’s voting power would increase from roughly 36.68% to 49.61%, bringing it close to outright control of shareholder votes.

EWCL is widely viewed as a vehicle tied to Bitmain and its financing arm Antalpha, following a series of transactions earlier this year that effectively repositioned Cango as a public-market shell for Bitmain’s proprietary mining assets. Cango, formerly a China-based automobile financing platform, has since exited that business and pivoted fully to bitcoin mining operations outside China.

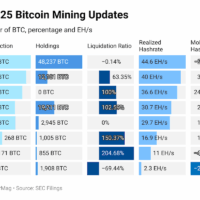

The additional capital injection comes at a challenging moment for Cango’s mining economics. According to TheMinerMag’s analysis of Cango’s third-quarter filings, the company’s fleet hashcost — excluding corporate and financing expenses — stood at about $39/PH/s. That level is already above the current network hashprice, indicating that Cango is likely mining at a gross loss before overhead costs are considered.

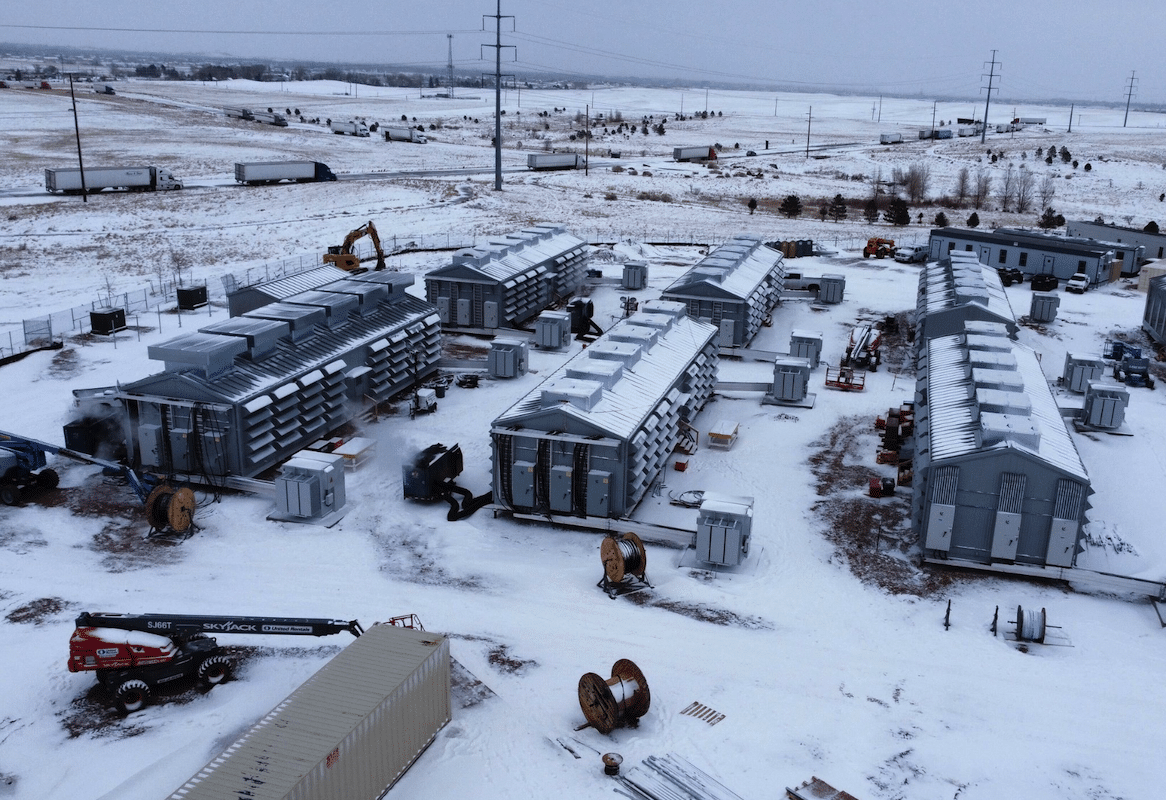

The company’s mining scale expanded rapidly this year after it agreed to acquire an additional 18 EH/s in an Antalpha-financed transaction, which boosted its total hashing capacity to 50 EH/s.

Share This Post: